twentySomething #1: “Hey looks like there’s still a lot of good snow, but it probably won’t last much longer so we’re thinking of going on one last snowboarding trip for a weekend before the season ends. You in? The snow will be great, and so will the weather.”

twentySomething #2: “That sounds great! Count me in!”

twentySomething #2 is a typical present-day young professional, nervous about his financial security due to the current economic situation. He has seen his portfolio plummet in the past year and is unsure about the stability of his current job. All of his fears and insecurities come to a head one week before the snowboarding trip and although snowboarding is one of his favorite hobbies, he decides, regretfully, that he absolutely must back out of this trip and save the money he would have spent. Snowboarding weekend rolls around, and he finds himself sitting at home thinking about how much he wishes he was having fun in the snow with his friends.

Then, a casual friend of his calls him up and asks him to go bar hopping that night. “I haven’t seen him in a month since the last time we had some drinks… I should go,” twentySomething #2 thinks to himself. Feeling down that he isn’t out snowboarding, he agrees to go out and ends up spending $100 on drinks and greasy late night food, resulting in a wasted weekend recovering from the throbbing hangover the morning after…. realizing he probably should have just gone snowboarding. Though he had fun during his night out, he probably wouldn’t have spent that much more money snowboarding (if at all), and he would have ended with a much happier weekend doing something he loves much more with close friends.

Does this situation sound familiar to you? From my observations, this type of situation is not uncommon.

These days, with all the attention drawn towards the recession, and saving money, resisting splurges… people are scrambling to eliminate expenses left and right. During this process, it is easy to put aside what makes you happy for the sake of saving a little money before thinking these decisions through. That means, it is also just as easy to end up spending some money for some instant (and probably short lived) gratification. I’ve realized that it is beneficial to take a little time and come up with some guidelines/a plan for “investing” in myself and my happiness. Therefore, in a tight money situation, I’d be able to think rationally about where to spend my money to maximize lasting gratification. This is a good time to ask yourself, Are you skimping too much?

In the aforementioned article, Personal Finance columnist Liz Pulliam Weston writes about finding a balance so that you don’t find yourself spending money on things you’ll regret later but at the same time you don’t look back regretfully on missed opportunities. I’ll leave it up to you to read the article (it seems to generally be geared towards a slightly older crowd), but I did want to highlight the a few of the questions she suggests thinking about:

- What would you do in a day, from the time you get up until the time you go to sleep? Account for every hour.

- Whom would you spend time with?

- What interests or passions would you explore?

After figuring out some answers to such questions, it’ll be easier to make commitments that maximize happiness and reduce guilt. This is what I have realized. At this age, we enjoy things like going out for drinks, for coffee, for meals. A friend calls us up on a Friday night to go downtown, and we’ll end up going out and spending $50 before we really have a chance to realize how doing this weekend after weekend really adds up. And really, how much happier are we after a month and -$200 later? However, these small occasions are needed to maintain a healthy and happy twentySomething lifestyle. We’ve all got to get out and let loose every once in awhile. So I’ve learned to make to make these decisions more consciously.

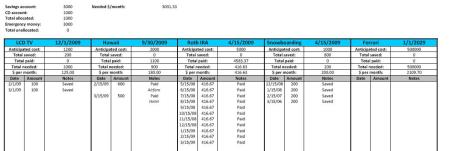

I give myself a “budget” for these type of outings and keep a mental tab of how often I’ve been out recently and how much I’ve been spending. If a friend asks me out for drinks, and I haven’t been out in awhile/I haven’t spent much money out, then I’ll go out and enjoy myself. Otherwise, I’ll politely decline… and feel okay about it because I had just gone out and enjoyed myself not too long ago. It probably isn’t a decision I’ll look back on and regret. As someone who naturally hates the thought of missing out on anything, I got to a point where I was stretching myself much too thin until I learned that nobody expects me to say yes all the time and that’s okay. Additionally, when the chance to go on a well deserved luxurious vacation with close friends come up shortly after, I’ll be able to commit wholeheartedly because it is within the guidelines I’ve set for myself. I’ll know that it is an experience I truly want to take part in, with those that matter to me most. And, I’ll have that much more money saved up towards it.

On a smaller scale, I’ve also learned to be conscious of smaller expenses that sneak up on you and add up such as going to the vending machine at work (guilty at least two/three times a month), getting Starbucks (3 coffees a week = $12 a week, or $48 a month or $576 a year!)… you get the idea. These are things you don’t think twice about because it’s just a couple dollars at a time, but they sure do add up. The main idea is to make money decisions more consciously so that you don’t make a mistake and find yourself eliminating random costs last minute because you’re freaking out.

Much like the way I maintain my financial portfolio, I also maintain a life portfolio. I figure out what’s important to me, what I want to do, what makes me happiest. I try to diversify my time, money, effort into work, fun, personal enrichment, etc. similarly to the way I try to diversify my money in stocks, funds, and bonds. I don’t hastily jump into one stock without thinking it through… and I accept small losses here and there when things don’t go the way I envision. I make mistakes from time to time. But I have faith that sticking with this strategy, I still come out stronger and happier than ever while wasting less time stressing out about things I don’t need to be. I encourage you to take a little time to similarly evaluate your life and happiness too, especially if you find yourself in a bit of a bind when it comes to time and money. :)

– debs.

p.s. If you have a lot of debt, or have little to no savings, I’m not in any way suggesting that you risk going broke. In this case, you’ll probably want to make paying off debt and saving a high priority in your goals/guidelines and refer to “Savings, Investments, Retirement… Where Do I Start?”

Edit: Here is another related article I stumbled across right after I wrote this entire post: “Oversaving, a Burden for Our Times“

Posted by Vince

Posted by Vince