Earlier in my budgeting endeavor, I had a problem determining how much money I needed to save each month in order to meet my goals. Instead, I would deposit as much money in my savings account as I could, and hope that I would have enough when it came time to spend money for my goal. After several missed and delayed goals, I realized that this system was terribly ineffective.

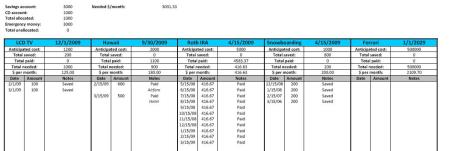

So I crafted an Excel spreadsheet to solve this problem, which I’d like to share with you – an Excel spreadsheet which will automatically tell you how much you need to save each month, and how close you are to your goals.

To use it, first enter in the amount in your savings accounts and CDs. Then specify the amount that you’d like to be set aside for emergencies. Then for each goal, enter a name, deadline, and total amount needed. The spreadsheet will then break down the amount needed per month to reach a goal’s deadline, as well as the total amount you need to save to meet all your goals. Each time you save or spend an amount toward your goal, you can enter it into the spreadsheet and categorize it as “Paid” or Saved” and the spreadsheet will automatically update the amounts needed.

I tested the spreadsheet out under a number of conditions. In this example, I have five goals set up: a new flatscreen TV, trip to Hawaii, Roth IRA, snowboarding, and a Ferrari. For the flatscreen TV, I want to save $100 a month for a $1200 flatscreen in time for Christmas, which it accurately calculates. For my Roth IRA deposits, I’m depositing the $5000 maximum this year every month (in order to practice dollar cost averaging – more on that later). I’ve also added an ambitious goal of saving up for a Ferrari for my anticipated midlife crisis – in order to meet this goal, I need a little over $2000 a month!

I’ve included a version for Excel 2007 and another for older versions of Excel. Download it and have fun playing around!

Why would you dollar cost average in an IRA? If it is in a money market/CDs, isn’t it better to get as much in at once and have it earning interest? Or are you buying stocks with that money? (and if so, why would you not put in as much now so as to buy low?)

I couldn’t tell ya where Vince puts his money to use within his IRA, but one of the major reasons people subscribe to the dollar-cost averaging (DCA in future reference) theory is they just don’t have that kind of lump sum money lying around. But in that case, I think that strategy falls under budgeting theory as much as it does the DCA model.

On the other hand, even during this advantageous (for 20something young’ns, anyway) economic turn there are daily/weekly/monthly ups and downs in the market, so DCA still makes sense right now. Isn’t volatility fun?

Yup, I agree with Artie. The idea is that you want to spread the risk of investing at a bad time as much as possible. That way, you aren’t as prone to volatility as you would be if you put it in all at once.

I understand DCA if you are putting the money into stocks, but putting $5K into a money market or CD (within an IRA) on Jan 2 every year will earn the most interest…no?

You’re totally right Cathy, when it comes to money market funds and CDs, since there’s no entry point (like the dollar value of a share) the sooner you can put money into those accounts to let them accrue interest, the more money your money will generate.

Yeah I agree with that. I guess I should’ve made it clear that I put my money in stocks/bonds/mutual funds in my Roth IRA.

OK. I was thinking of a younger (20’s) person starting a Roth and going to a bank/credit union and playing it safe. DCA I think of more with a 401K/Roth 401K.

Love your site. Diverse. Thanks for mentioning the Art scene in San Diego.

Ah that makes sense. Actually that’s sort of what I do – play it safer in the IRA (and max it out as quickly as possible) and riskier in the 401k, which is deducted bi-weekly from my paycheck so it’s kind of a forced DCA.

Thanks Cathy, I’m a big fan of yours too (duh)! It’s one of the selected few in my RSS feeder. Which, coincidentally enough, is the topic of a forthcoming post!

Obviously we’re just starting out, but if we garner half the readership you guys have, I’ll be pretty stoked.

Cathy, I’m a huge fan of your site! I can’t tell you how much we (me, RT, and Debs) love your site…I can definitely say that you are the reason why we go to Ba Ren regularly, among other restaurants you review.

Thanks for reading and I hope that we can keep in touch!

Just two quick points I wanted to make. A balanced portfolio should aim to do two things: maximize tax savings and minimize risk.

1) A balanced portfolio should strive to maximize tax savings. Gains in Roth IRAs are tax-free, so investments that are heavily taxed (stocks/mutual funds/some types of bonds) should be in here while money market/CDs can be placed in a taxed account since the gains (and resulting taxes) are small.

2) Having a balanced portfolio is important to minimize risk. This means that the investor has enough to diversify their investments in order to reduce their perceived risk. A very general rule of thumb is 100%-(your age) is the amount you should have in high-risk investments (stocks, funds) and the rest should be in low-risk investments (some bonds, money market, CDs). The reasoning is that younger people don’t make much to begin with and have more time to make up for losses.

So all this means that if one has enough to have a diversified portfolio of stocks/funds/bonds/money market/CDs, then I’d say that DCA of high-risk investments should be used in a Roth IRA to further minimize exposure to risk. By having these investments in the Roth IRA they can maximize their tax savings.

I’ve been using a notebook called My Sister’s Budget and I have carved out a little money each month to save for some things I have been wanting to get…a new heater for my hot tub comes first. I have even got a little saved that I think I might want to invest in something soon. Everything is low right now, right?

Great job on the budgeting Jeanette – your system sounds great!

I’d say that it’s a great time to invest…then again, I would say that anytime is a good time – it just depends on what you invest in!

There’s no question that stocks are a lot lower than they were the past four years. The issue is whether their values were inflated before, rendering their current value to be around their actual value, or that recent events have caused their current perceived value to be below their actual value.

There’s no easy answer. But the correct thing to do is to research what investments are right for you. The key phrase is “right for you” – some like to spend the hours of 9:30-4pm hopped up on red bull to day trade, some like to research a a few hours a day during off hours, and others take a more laissez-faire approach and monitor their portfolios a few times a month. I’m a combination of the latter two. Depending on which category you fall under, different investment strategies are ideal.

Thanks for reading and feel free to drop more comments!

Thanks for the nice words about our little blog. It is not related to what any of us do in our other/”real” lives and a diversion/different way of thinking for all three of us.

Its now best time to invest but of course have to be wise and monitor closely especially shares.

Nice to be able to Ferrari!!!

Hey Jeannette, if you think you’re going to want to invest soon I would recommend first deciding what your risk-aversion level is. In other words, are you OK with losing, say, half your money within a month even though there’s a good possibility it will return within the year?

Stocks are always the riskier choice, so you may want to do more research on which stocks/stock funds to invest in. Otherwise, CDs and bonds are great starting points for investing because they give definite returns (you won’t lose money!), but the returns just won’t be as big as ones you might see on riskier investments.

Does that help?